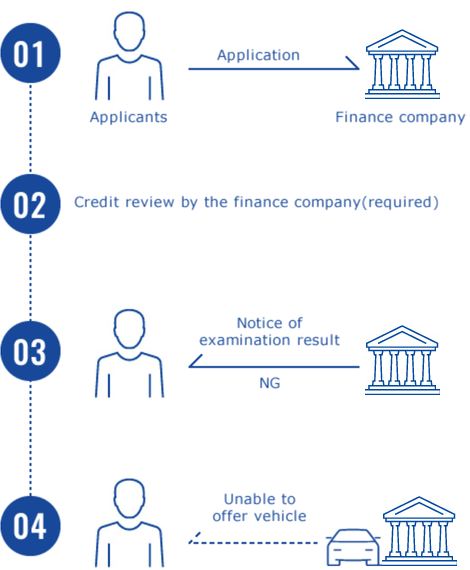

In the emerging ASEAN countries, unlike Japan, it has been necessary to carefully review loans and leases due to the fact that there has been no institution in charge of providing individual credit information.

Due to this background, many categorized as the BOP (underclasses) are unable to purchase new vehicles. The only way for those in the BOP to own vehicles is to purchase cheap old units which cause problems of loud noise and heavy exhaust emissions.

Such cases can be seen in many emerging countries, and it has been kept far from reaching a fundamental solution.

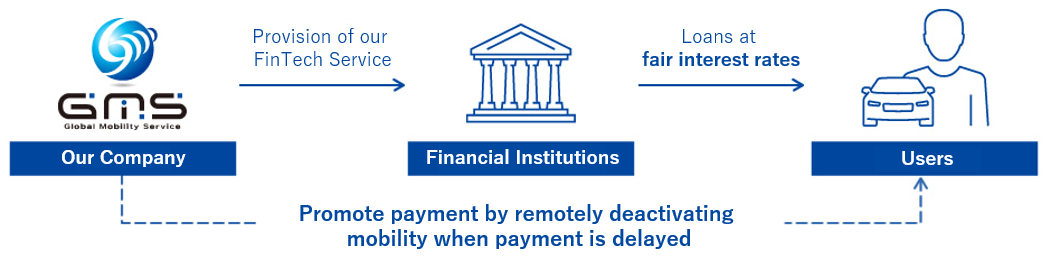

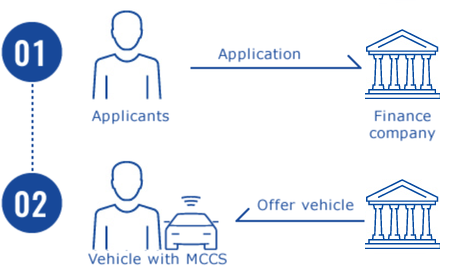

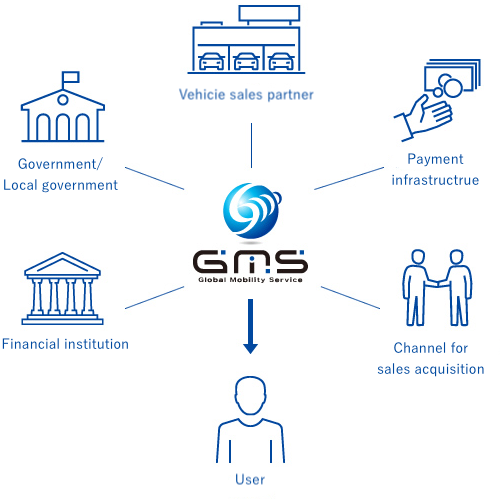

Amidst this situation, GMS has succeeded in creating a business model which focuses both on economic rationality and "sustainability" in the true sense. Our local subsidiary in the Philippines has chalked up steady achievements since it took off as our primary business. We plan to extend our reach in Asia, including Japan, and actively expand our business parternering with financial institutions.